How Does Bitcoin Cash Work? Your Ultimate Guide

You’ve heard of Bitcoin, but what about its faster, cheaper sibling – Bitcoin Cash? Born from Bitcoin’s genesis and then hard forked from Bitcoin (BTC) in 2017, Bitcoin Cash aimed to solve Bitcoin’s scalability issues. But exactly how does Bitcoin Cash work?

I want to break it down for you in simple terms. No jargon, no technobabble. Just a clear understanding of what makes Bitcoin Cash tick and why it matters. Whether you’re a crypto newbie or a seasoned pro, stick with me. We’ll unpack the ins and outs of Bitcoin Cash together.

Table Of Contents:

BCHFAQ Flipstarter - Phase 2

Join the Bitcoin Cash Revolution: Fund More Informative Content on BCHFAQ

What Is Bitcoin Cash and How Does It Work?

Bitcoin Cash is a cryptocurrency that traces its lineage from the original Bitcoin. It emerged as a cryptocurrency distinct from BTC after a hard fork of the Bitcoin blockchain in 2017. It shares many similarities with BTC, but with some key differences that make it unique.

Overview of Bitcoin Cash

At its core, Bitcoin Cash operates on the same basic principles as BTC. It’s a decentralized digital currency that enables users to send and receive payments without the need for intermediaries like banks. Transactions are recorded on a public ledger called the blockchain, and new units of the currency are created through a process called mining. Miners use powerful computers to solve complex mathematical problems, and in return, they’re rewarded with newly minted Bitcoin Cash.

How Bitcoin Cash Differs from Bitcoin

While Bitcoin Cash and BTC share a common history, they have some significant differences. The most notable is the block size. Bitcoin limits the size of each block to 1MB, which can lead to slower transaction times and higher fees during periods of high network activity. Bitcoin Cash, on the other hand, allows for blocks up to 32MB in size. This means it can process more transactions per second and keep fees lower.

This difference in block size is rooted in a philosophical divide within the Bitcoin community. Some believed that increasing the block size was necessary for Bitcoin to scale and become a viable payment method for everyday transactions. Others argued that larger blocks would lead to centralization, as only large-scale miners would have the resources to mine them and very expensive hardware would be required to maintain the network.

As a result of the divide, the BTC community has largely capitulated on the idea of using their coin as a medium of exchange. Extremely high fees have very often disrupted payment method possibilities. Instead BTC users prize it primarily as an investment vehicle, continually expecting greater and greater returns in terms of fiat currency.

On the other hand, fans of Bitcoin Cash continue to promote BCH as an easy-to-use medium of exchange. Worries about returns on investments are a secondary concern. Despite fears from the small block side of the debate, Bitcoin Cash nodes are very easy to maintain, even during periods of high usage.

Bitcoin Cash’s Block Size and Transaction Fees

By increasing the block size to 32MB, Bitcoin Cash aims to process transactions more quickly and keep fees low, even as adoption grows. According to BitInfoCharts, the median transaction fee for Bitcoin Cash is typically less than a penny.

Compare that to BTC median fees, where fees can spike to dozens of dollars during times of congestion. This makes Bitcoin Cash an attractive option for those looking to use cryptocurrency for small, everyday purchases. With lower fees, it becomes more practical to buy a cup of coffee or pay for a meal with Bitcoin Cash.

To ensure continual scalability, this month (May 2024) Bitcoin Cash will enable an Adaptive Blocksize Limit Algorithm (ABLA). The algorithm allows the blocks to grow with usage, enabling a maximum growth of 2x per year. The Bitcoin Cash community may have solved scalability for the long term as the blockchain will be able to handle high volume and adoption over time.

Buying and Storing Bitcoin Cash

If you’re interested in buying Bitcoin Cash, you have several options. Many popular cryptocurrency exchanges, such as Coinbase and Kraken, allow you to buy, sell, and trade Bitcoin Cash. Once you’ve bought some Bitcoin Cash, you’ll need to store it in a reputable Bitcoin Cash wallet. You can choose from software wallets that you install on your computer or smartphone, or hardware wallets that keep your cryptocurrency offline for added security.

Key Takeaway:

Bitcoin Cash distinguishes itself with a larger block size, enabling faster transactions and lower fees. While BTC has shifted focus towards investment, Bitcoin Cash maintains its vision as a practical medium of exchange. Its Adaptive Blocksize Limit Algorithm promises scalability, ensuring it remains viable for everyday transactions.

The History and Emergence of Bitcoin Cash

To understand Bitcoin Cash, it’s helpful to know a bit about its history and the events that led to its existence.

The Scaling Debate and Hard Fork

As Bitcoin grew in popularity, it began to run into scaling issues. The network could only process a limited number of transactions per second, leading to slower confirmation times and higher fees during periods of high activity.

This sparked a debate within the Bitcoin community about how to best scale the network. Some favored increasing the block size to allow for more transactions per block. Others preferred off-chain scaling solutions like the Lightning Network. The debate came to a head in 2017. When a group of miners and developers couldn’t find any recourse for a path forward, they initiated a hard fork, creating Bitcoin Cash as a distinct cryptocurrency with a larger block size.

Read More: What is the Difference Between Bitcoin and Bitcoin Cash? – Part 1: Origins and Scaling

The Continual Evolution of Bitcoin Cash

Bitcoin Cash is an open protocol and anyone is welcome to contribute through Cash Improvement Proposals (CHIPs). Without an official foundation or node implementation, there is no single group or development team in charge who can force changes or stall progress. It’s up to individual initiative to propose improvements, gather stakeholder support, and guide the upgrade process to the finish line.

Read More: What is the Difference Between Bitcoin and Bitcoin Cash – Part 3: Coordinating Consensus

Since the 2017 split with BTC, Bitcoin Cash has undergone numerous hard forks and improvements. These upgrades have focused on scalability, efficiency, and versatility. Some of the other many improvements over the years include:

The elimination of the hard block size limit (opting for a configurable soft limit), allowing for many more transactions.

The removal of Replace-By-Fee (RBF) to prioritize transaction speed and reliability.

Enhancements such as Schnorr signatures and optimizations to the node software, improving transaction efficiency and block propagation.

Double-Spend Proofs (DSPs) which can alert merchants of fraud attempts, discouraging double-spends.

An increase in the OP_RETURN size allows for the insertion of metadata into transactions, enabling novel app use cases.

Native introspection, allowing for access to transaction details, simplifying contract development.

The introduction of native tokens with CashTokens, expanding BCH’s use cases, allowing for a diverse ecosystem of DeFi applications.

Bitcoin Cash’s continual evolution reflects its commitment to addressing scalability challenges while enhancing functionality and usability for a wide range of applications.

Read More: What is the Difference Between Bitcoin and Bitcoin Cash? – Part 4: Divergent Evolution Explored

Key Takeaway:

Bitcoin Cash emerged at the end of the scaling debate within the Bitcoin community in 2017, with proponents advocating for a larger block size to address network congestion. Since then, it has evolved through open protocol contributions, embracing scalability improvements and functionality enhancements. With its commitment to continual evolution and adaptability, Bitcoin Cash remains focused on providing a practical and versatile medium of exchange, distinct from BTC’s investment-centric trajectory.

How Bitcoin Cash Transactions Work

At a high level, Bitcoin Cash transactions work very similarly to Bitcoin transactions. However, there are some key differences at play.

Transaction Processing and Confirmation

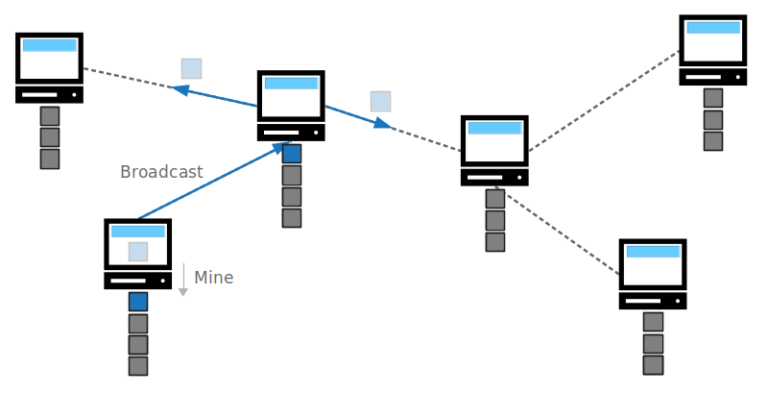

When you send Bitcoin Cash, your transaction is broadcast to the network and added to the mempool of the various nodes, a waiting area for unconfirmed transactions. Miners then pick transactions from the mempool, verify them, and include them in a new block. Once a transaction is included in a block and that block is added to the blockchain, the transaction is considered confirmed. The more subsequent blocks are added after the block containing your transaction, the more secure that transaction becomes.

Even so, unconfirmed transactions can almost always be considered safe. Bitcoin Cash nodes operate on the “first-seen” rule. That means that nodes will accept the first version of a transaction that they see and reject alternate versions that spend a coin differently.

Of course, double-spends are technically possible, but they are extremely complicated, expensive, and risky. Not to mention, a successful double-spend likely necessitates collusion with a miner.

Since double-spends are not worth such a massive effort for values less than several thousand dollars, common small-value transactions are all-but-guaranteed to get into the next block. The existence of Double-Spend Proofs (DSPs) makes fraud even more unlikely. Thus, zero-confirmation (0-conf) transactions are generally very secure.

Mining and Consensus Mechanism

Just like Bitcoin, Bitcoin Cash uses a Proof-of-Work (PoW) consensus mechanism. Miners compete to add new blocks to the blockchain by finding a solution to a cryptographic puzzle. The first miner to solve the puzzle gets to add the next block and is rewarded with newly minted Bitcoin Cash and transaction fees. This process helps secure the network and prevent a reorganization of the blocks of transactions, which would allow an attacker to double-spend confirmed transactions. To successfully reorg the blockchain, an attacker would likely need to control more than 50% of the network’s mining power, which is extremely difficult and expensive to do.

Comparing Transaction Speeds and Fees to Bitcoin (BTC)

Thanks to its larger block size, Bitcoin Cash can process more transactions per second than BTC. This leads to faster transaction times. Because of BTC’s limited (1MB) block size, users and their transactions are always in competition with each other. Due to this and the fact that BTC allows double-spends to increase the fees of stuck transactions, BTC is no longer considered safe for instant payments. Instead, merchants accepting BTC must wait for at least one confirmation before finalizing a sale.

As for fees, Bitcoin Cash transactions are much cheaper. Even during periods of high network activity, the median Bitcoin Cash fee is always under a penny, while BTC fees can climb to dozens of dollars.

Key Takeaway:

Bitcoin Cash transactions function similarly to BTC but with notable distinctions. Transactions are processed through a decentralized network of nodes and miners, with confirmations adding security to the transaction. With its larger block size, Bitcoin Cash offers faster transaction speeds and lower fees compared to BTC, making it a more practical choice for everyday transactions. The network’s reliance on Proof-of-Work consensus mechanism ensures security, making double-spending attempts exceedingly difficult and costly. Overall, Bitcoin Cash provides a secure and efficient medium of exchange, particularly suited for smaller value transactions.

Advantages and Disadvantages of Using Bitcoin Cash

Like any cryptocurrency, Bitcoin Cash has its pros and cons. Let’s take a look at some of the key advantages and disadvantages.

Faster and Cheaper Transactions

One of the biggest selling points of Bitcoin Cash is its ability to process transactions more quickly and cheaply than BTC. This makes it more viable for small, everyday transactions.

Imagine you want to buy a coffee with cryptocurrency. With Bitcoin, you’re likely to end up paying more in transaction fees than the cost of the coffee itself. Not to mention the wait for a confirmation makes point-of-sale transactions mostly unfeasible. With Bitcoin Cash, the fees would be negligible and 0-conf transactions are safe, making it a more practical payment option.

Wider Acceptance and Adoption

Bitcoin Cash has been gaining traction in the payments space. Many businesses that accept BTC also accept Bitcoin Cash, and some even prefer it due to its lower fees and faster transaction times. Moreover, Bitcoin Cash has a strong community of supporters who are actively working to drive adoption. This includes development of user-friendly wallets, partnerships with merchants, and educational initiatives to help more people understand and use Bitcoin Cash.

Volatility and Market Fluctuations

Like all cryptocurrencies, the price of Bitcoin Cash can be highly volatile. It’s not uncommon to see double-digit percentage swings in a single day. This volatility can be a double-edged sword. On one hand, it presents opportunities for traders to make significant profits. On the other hand, it makes Bitcoin Cash a risky store of value, as your holdings could drastically decrease in value overnight.

Competition from Other Cryptocurrencies

Bitcoin Cash isn’t the only cryptocurrency aiming to be a fast and cheap payment method. It faces competition from a wide range of other coins, each with their own unique features and value propositions. Some notable competitors include Litecoin, which took cues from BTC but implemented faster block times; and DASH, which implements instant transactions and enhanced privacy. To stay competitive, Bitcoin Cash will need to continue innovating and delivering on its promises of being a reliable, low-cost payment system with peer-to-peer capabilities that consumers want.

Key Takeaway:

Bitcoin Cash offers faster and cheaper transactions compared to BTC, making it a practical choice for everyday purchases. Its wider acceptance and growing adoption in the payments sector are bolstered by a supportive community actively driving its use. However, volatility can be a concern, posing risks for holders amid market fluctuations. Additionally, Bitcoin Cash faces competition from other cryptocurrencies also vying for dominance in the fast and low-cost payment niche. To maintain relevance, Bitcoin Cash must continue innovating and delivering on its promise of reliability and affordability in transactions.

How to Buy, Sell, and Store Bitcoin Cash

If you’re interested in buying, selling, or storing Bitcoin Cash, here’s what you need to know.

Buying Bitcoin Cash on Exchanges

The easiest way to buy Bitcoin Cash is through a cryptocurrency exchange. Some popular exchanges that support Bitcoin Cash include:

To buy Bitcoin Cash on an exchange, you’ll need to create an account, verify your identity, and link a payment method. Once your account is set up, you can place an order to buy Bitcoin Cash at the current market price or at a specified limit price.

Alternative Methods of Buying Bitcoin Cash

If exchanges aren’t your thing, there are a few other ways to purchase Bitcoin Cash.

Zapit P2P marketplace: Use the Zapit wallet to trade directly with BCH sellers around the world.

Stack Wallet: Swap for or purchase BCH directly in the app.

Crypto ATM: Find a local cryptocurrency ATM near you to purchase BCH with cash or card.

Bitgree: Intermediate Amazon purchases using your fiat currency to earn BCH.

Sideshift: Choose between 100+ currencies to swap for BCH.

Read More: How to Buy Bitcoin Cash: Your Ultimate Guide in 2024

Storing Bitcoin Cash in Wallets

After buying Bitcoin Cash, it’s crucial to store it in a secure wallet. There are several types of wallets to choose from:

Software wallets: These are apps that you install on your computer or smartphone. Examples include Electron Cash and Paytaca.

Hardware wallets: These are physical devices that keep your Bitcoin Cash offline for added security. Popular options include Trezor and KeepKey.

Paper wallets: These are physical printouts of your public and private keys. They offer a high level of security but require careful management.

When choosing a wallet, consider factors like ease of use, security features, and compatibility with other platforms and services.

Read More: Bitcoin Cash FAQ Knowledge Base Category: Wallets

Selling and Trading Bitcoin Cash

If you want to sell your Bitcoin Cash, the process is similar to buying. You can sell on a cryptocurrency exchange by placing a sell order at the current market price or a specified limit price. You can also trade Bitcoin Cash for other cryptocurrencies. Many exchanges offer BCH trading pairs with coins like BTC, Ethereum, and stablecoins like Tether.

When selling or trading Bitcoin Cash, be aware of factors like fees, price volatility, and the reputation of the platform you’re using. Always do your own research and never invest more than you can afford to lose. And make sure you are aware of your tax liabilities in your jurisdiction.

Key Takeaway:

To engage with Bitcoin Cash, individuals can easily purchase it through various exchanges or alternative methods like P2P marketplaces, crypto ATMs, or intermediary services. After acquiring Bitcoin Cash, storing it securely is crucial, with options ranging from software and hardware wallets to paper wallets. When ready to sell or trade, users can do so on exchanges, mindful of fees, volatility, and platform reputation. As with any investment, conducting thorough research and understanding tax implications is essential to mitigate risks.

Conclusion

So, there you have it – the lowdown on how Bitcoin Cash works. We’ve covered the key differences from BTC, like bigger block sizes and faster, cheaper transactions. Plus, we didn’t skip on explaining the whole deal about how your Bitcoin Cash moves—getting mined and checked off as confirmed.

But beyond the technical stuff, what’s the big picture? Bitcoin Cash aims to be a true peer-to-peer electronic cash system, one that’s accessible and practical for everyday use. Even though BCH is up against market swings and rivals at every turn, it’s slowly but surely finding its own spot under the crypto sun.

The future of Bitcoin Cash? That’s still being written. But one thing’s for sure – understanding how it works is the first step to deciding if it’s right for you. Whether you’re looking to invest, spend, or just stay informed, I hope this guide has shed some light on the world of Bitcoin Cash.

Stay in the loop – subscribe to receive instant notifications on our latest blog posts, delivered straight to your inbox