Can Bitcoin Cash Scale? Understanding Its Potential

Have you ever wondered whether Bitcoin Cash (BCH) can truly scale to meet the demands of everyday transactions? If you’re a crypto enthusiast or just curious about its potential, you’re in the right place. With its increased block size limit designed to handle more transactions per second compared to Bitcoin’s (BTC) smaller blocks, many believe it holds promise. But how does it stack up in reality?

Today we’ll break down what makes this cryptocurrency tick and whether it’s equipped for mass adoption.

Table of Contents:

Bitcoin’s Scalability Issues

Bitcoin Cash’s Larger Block Size

Transaction Fees and Times

Network Capacity

BCHFAQ Flipstarter - Phase 2

Join the Bitcoin Cash Revolution: Fund More Informative Content on BCHFAQ

What Is Bitcoin Cash and How Does It Work?

Bitcoin Cash is a cryptocurrency that is for people who like Bitcoin, but don’t exactly support its scaling solutions. Bitcoin Cash aims to never completely depend on off-chain solutions such as the Lightning Network, and wants to create a digital payment solution in the vision of Satoshi Nakamoto, the creator of Bitcoin. Though the two currencies continue to diverge farther from each other, the original key differences between BTC and Bitcoin Cash came down to the block size limit, transaction fees, and transaction speed.

The Origins of Bitcoin Cash

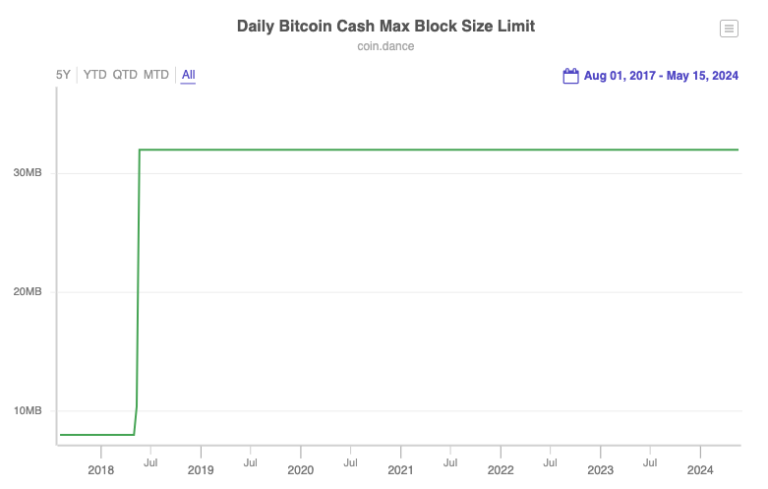

The origins of Bitcoin Cash trace back to a hard fork that occurred in 2017. Essentially, the Bitcoin Cash hard fork happened because the Bitcoin community couldn’t agree on how to scale the network to accommodate more transactions. One camp wanted to increase the block size limit, while the other preferred to implement Segregated Witness (SegWit) and the Lightning Network. Ultimately, from the hard fork emerged Bitcoin Cash. By increasing the block size to 8 and then 32 MB, Bitcoin Cash aimed to process transactions faster and cheaper than BTC.

Read More: What is Bitcoin Cash? – A Guide for Beginners

How Bitcoin Cash Transactions Work

At its core, Bitcoin Cash transactions work very similarly to Bitcoin transactions. It’s a decentralized, peer-to-peer electronic cash system that allows users to send and receive funds without the need for intermediaries. When you initiate a Bitcoin Cash transaction, it gets broadcast to the Bitcoin Cash network. Miners then pick up the transaction, verify it, and include it in a block. Once a block is mined, the transaction is considered confirmed.

Read More: How Does Bitcoin Cash Work? Your Ultimate Guide

The larger block sizes on the Bitcoin Cash network mean that more transactions can fit into each block, leading to faster confirmation times. You can buy Bitcoin Cash on most major cryptocurrency exchanges like Coinbase, CoinEX, or Kraken.

Alternatively, you can trade other cryptos for Bitcoin Cash at SideShift, or purchase Bitcoin Cash peer-to-peer through the Zapit or Paytaca wallets.

Read More: How to Buy Bitcoin Cash: Your Ultimate Guide in 2024

Key Features of Bitcoin Cash

One of the defining features of Bitcoin Cash is its commitment to on-chain scaling. By increasing the block size limit, Bitcoin Cash aims to keep transaction fees low and confirmation times fast, even as adoption grows.

This contrasts with BTC’s approach, which has involved the implementation of layer-2 solutions like the Lightning Network to scale with less-than-stellar results.

Bitcoin Cash also has some other notable features:

21 million coin supply cap (same as BTC)

Proof-of-work mining using the SHA-256 algorithm

Adjustable block size limit

Faster transaction times compared to BTC

Lower transaction fees compared to BTC

Ultimately, Bitcoin Cash was designed to be a more scalable version of BTC that can function better as a medium of exchange. The question is, can Bitcoin Cash scale better than BTC in the long run?

Key Takeaway:

Bitcoin Cash emerged from a 2017 hard fork of Bitcoin and aims to offer faster, cheaper transactions through larger block sizes and on-chain scaling, positioning itself as a scalable, decentralized digital payment solution in line with Satoshi Nakamoto’s vision, in contrast to Bitcoin’s reliance on off-chain solutions like the Lightning Network.

Can Bitcoin Cash Scale Better Than Bitcoin?

The original reason for the existence of Bitcoin Cash as a separate coin was to address Bitcoin’s scalability issues, so it’s natural to wonder whether BCH has actually succeeded in this regard. The short answer is: it’s complicated.

Bitcoin’s Scalability Issues

To understand why scalability is such a big deal, we need to take a closer look at how Bitcoin works. Every transaction that happens on the Bitcoin network needs to be verified and added to the blockchain, which is essentially a public ledger of all transactions. The problem is that as more people start using Bitcoin, the number of transactions increases, and the network can get bogged down. This, combined with BTC’s insistence on a 1 MB block size, leads to slower transaction times and higher fees, which can make BTC less practical for everyday use.

Bitcoin Cash’s Larger Block Size

As I mentioned earlier, one of the key differences between Bitcoin and Bitcoin Cash is the block size limit. By increasing the block size to 32MB and beyond, Bitcoin Cash aims to process more transactions per block, which greatly helps alleviate the scalability issues.

Transaction Fees and Times

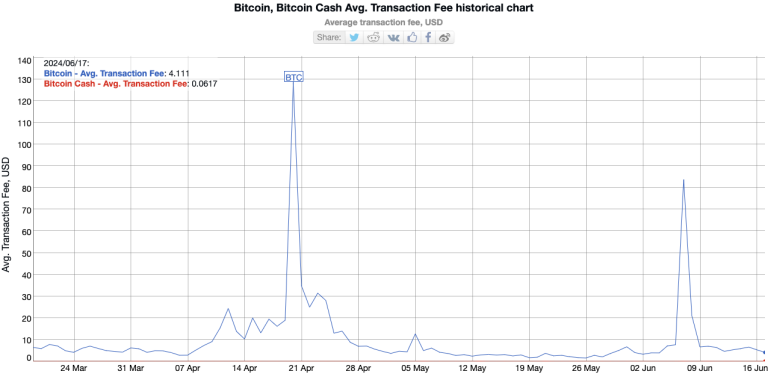

One of the main benefits of Bitcoin Cash’s larger block size is that it should lead to lower transaction fees and faster confirmation times. And in practice, this has generally been the case. According to data from BitInfoCharts, at the time of writing the median transaction fee for Bitcoin Cash is currently far less than a penny, while BTC’s median fee is more than two dollars.

Similarly, the average confirmation time for BCH is about 5 minutes, while Bitcoin transactions can take significantly longer during times of high network congestion. Additionally, with Bitcoin Cash’s 0-conf capabilities, payments can be considered final in seconds.

Network Capacity

Of course, transaction fees and times are only part of the equation when it comes to scalability. The other key factor is network capacity, which refers to the total number of transactions that the network can handle at any given time. The BTC network currently processes around 3-4 transactions per second on average. Bitcoin Cash, on the other hand, has a theoretical capacity of around 100 transactions per second with its current 32MB block size.

While this is certainly an improvement over Bitcoin, it’s still a far cry from the thousands of transactions per second that payment networks like Visa can handle. So while Bitcoin Cash may offer better scalability than Bitcoin in the short term, there’s still a lot of work to be done to truly compete with traditional payment methods on a global scale.

Read More: What is the Difference Between Bitcoin and Bitcoin Cash?

Key Takeaway:

Bitcoin Cash exists to address BTC’s scalability issues by increasing the block size to 32MB and beyond, enabling more transactions per block, which results in lower fees and faster confirmation times. While it offers better scalability than Bitcoin, it still has a long way to go to match the transaction capacity of traditional payment networks like Visa.

The Adaptive Blocksize Limit Algorithm (ABLA) Upgrade

The Adaptive Blocksize Limit Algorithm (ABLA) upgrade is a game-changer for Bitcoin Cash’s scalability. It’s designed to make the network more efficient and capable of handling a much higher volume of transactions.

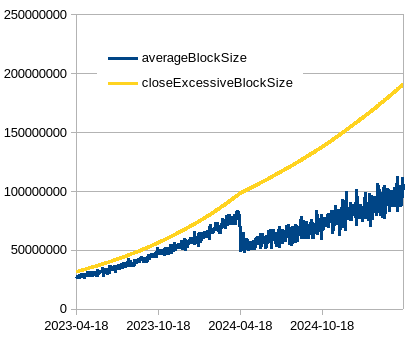

How ABLA Works to Improve Scalability

ABLA dynamically adjusts the block size limit based on network demand. This means that during periods of high transaction activity, the block size can increase to accommodate more transactions. The algorithm can determine the optimal block size after each block. By adapting to real-time conditions, ABLA enables Bitcoin Cash to scale more effectively. It removes the need for hard-coded block size limits, which can become bottlenecks as adoption grows.

Potential Impact on Transaction Throughput

The implications of ABLA for Bitcoin Cash’s transaction throughput are significant. With a more flexible block size, the network can potentially process a much higher number of transactions per second. This is crucial for Bitcoin Cash’s goal of becoming a viable payment system for everyday transactions.

You can already buy your morning coffee with Bitcoin Cash, without worrying about confirmation times or high fees. Imagine anyone in the world being able to do that, unconcerned about congestion. ABLA brings us closer to that reality by optimizing the network’s capacity to handle increased transaction volume. It’s a major step forward in answering the question: Can Bitcoin Cash scale?

Key Takeaway:

The Adaptive Blocksize Limit Algorithm (ABLA) upgrade enhances Bitcoin Cash’s scalability by dynamically adjusting block sizes based on network demand, significantly increasing transaction throughput and making BCH a more efficient and viable payment system for everyday use.

The Future Scalability Roadmap for Bitcoin Cash

ABLA is just one part of Bitcoin Cash’s broader scalability roadmap. The community is constantly exploring new ways to optimize the network and prepare it for mass adoption.

Planned Upgrades and Protocol Changes

In addition to ABLA, there are several other upgrades and protocol changes in the works for Bitcoin Cash. These include:

UTXO commitments: A cryptographic mechanism designed to efficiently verify the unspent transaction outputs (UTXOs) within the blockchain, enhancing scalability and security by enabling faster validation of the blockchain state.

Xthinner: A block compression technique that can minimize the bandwidth required to propagate blocks, further optimizing network performance.

Blocktorrent: A protocol enhancement that enables the parallel download and validation of blockchain data, significantly improving the speed and efficiency of block propagation across the network.

These upgrades, combined with ABLA, form a multi-pronged approach to scaling Bitcoin Cash. By tackling the problem from various angles, the community aims to create a robust and future-proof network.

Projections for Capacity and Adoption Growth

With these scalability upgrades and solutions in place, Bitcoin Cash is poised for significant growth in both capacity and adoption. Some projections suggest that the network could eventually support thousands of transactions per second, rivaling the throughput of major payment processors like Visa.

Of course, scalability is just one piece of the puzzle. For Bitcoin Cash to truly succeed as a global payment system, it will need to continue driving merchant adoption and user-friendly interfaces. But with a clear roadmap for scaling and a dedicated community behind it, Bitcoin Cash is well-positioned to tackle these challenges head-on.

The future looks bright for this ambitious cryptocurrency project. As always, only time will tell if Bitcoin Cash can truly live up to its scalability promises. But one thing is certain: the community is not afraid to innovate and push the boundaries of what’s possible with blockchain technology.

Key Takeaway:

Bitcoin Cash’s future scalability roadmap includes multiple upgrades like ABLA, UTXO commitments, Xthinner, and Blocktorrent, which collectively aim to enhance transaction throughput, optimize network performance, and prepare BCH for mass adoption, potentially enabling it to rival major payment processors like Visa.

Conclusion

Bitcoin Cash aims for larger blocks—providing faster transaction times at lower costs compared with most cryptocurrencies stuck under their old constraints. Of course, believing that scaling blockchain technology like BCH doesn’t come without hurdles isn’t accurate.

Can bitcoin cash scale? The answer lies somewhere between yes and maybe—it has made significant strides with larger blocks and reduced transaction fees but faces criticisms around adoption challenges and a lack of easy tooling for developers.

Surely challenges remain—no system’s perfect—but seeing what BCH already achieves gives hope towards sustainable growth without sacrificing decentralization.

And with dynamic block sizes allowing more transactions per second at lower costs than BTC and other major cryptos, there’s undeniable promise here!

Stay in the loop – subscribe to receive instant notifications on our latest blog posts, delivered straight to your inbox