Is Bitcoin Cash a Good Investment? Pros, Cons & Potential

You’ve heard the buzz about Bitcoin Cash (BCH), but is it really a good investment? I get it, the world of crypto can be confusing and overwhelming. Relax and stay with me; we’re about to explore whether it’s worth making room for BCH in that diverse portfolio of yours.

First off, let’s talk about what makes Bitcoin Cash unique. Imagine this – you’re using something like Bitcoin, yet it’s been tweaked to work almost instantly and with fees of less than a penny. That’s right, no more waiting forever for transactions to go through or paying sky-high fees.

But is that enough to make it a smart investment? Let’s dive in and find out.

Table Of Contents:

Bitcoin Cash Price Prediction for 2025

BCHFAQ Flipstarter - Phase 2

Join the Bitcoin Cash Revolution: Fund More Informative Content on BCHFAQ

Bitcoin Cash Price Prediction

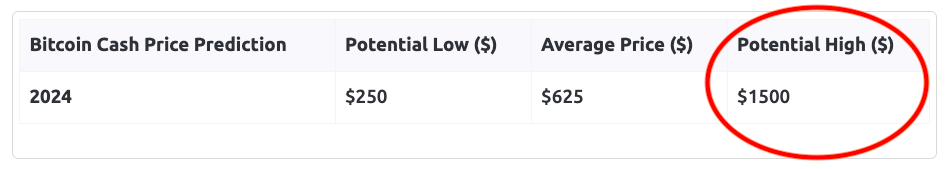

Bitcoin Cash has been on a wild ride since it forked away from BTC in 2017. It’s had its ups and downs, but many believe it’s got a bright future ahead. So, what’s the deal with Bitcoin Cash price predictions? Let’s take a look at what the experts are saying. According to some analysts, Bitcoin Cash could reach a maximum price of $1,500 by the end of 2024. That’s a pretty bullish prediction, but it’s not totally out of the realm of possibility. The thing is, BCH has a lot going for it. It’s got faster transaction speeds and lower fees than Bitcoin, which could make it more attractive to businesses and everyday users. Plus, the recent halving event of 2024 could give the price a boost. Historically, halvings have led to big price increases for cryptocurrencies. Finally, this year Bitcoin Cash will activate its Adaptive Blocksize Limit Algorithm (ABLA), which will allow for larger blocks when demand increases.

Bitcoin Cash Price Prediction for 2025

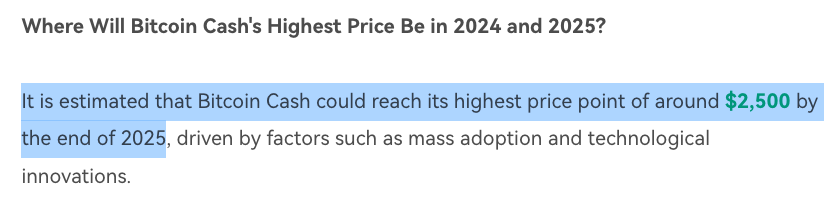

Looking a little further ahead, some Bitcoin Cash price predictions for 2025 are even more optimistic. Some folks are calling for a maximum price of $2,500 or more. Of course, a lot can happen in a few years. But if Bitcoin Cash can continue to gain adoption and prove its usefulness, there’s no telling how high the price could go.

Bitcoin Cash Forecast for 2030

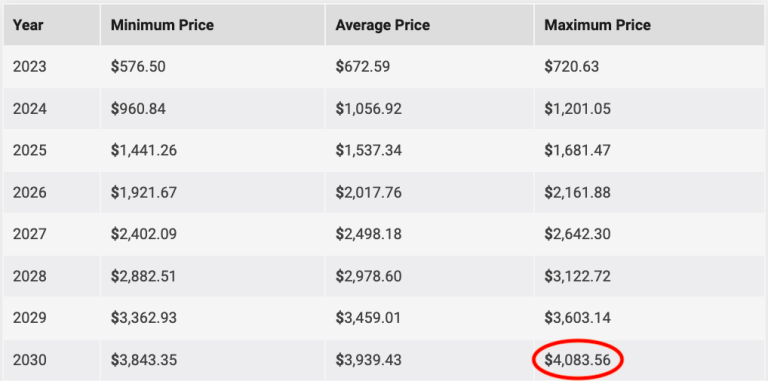

Now, I know what you’re thinking. 2030? That’s like a lifetime away in the crypto world. And you’re right, it’s hard to predict what will happen that far out. But some brave souls have taken a stab at it anyway. One Bitcoin Cash price forecast for 2030 sees the coin reaching a staggering $4,000 or more.

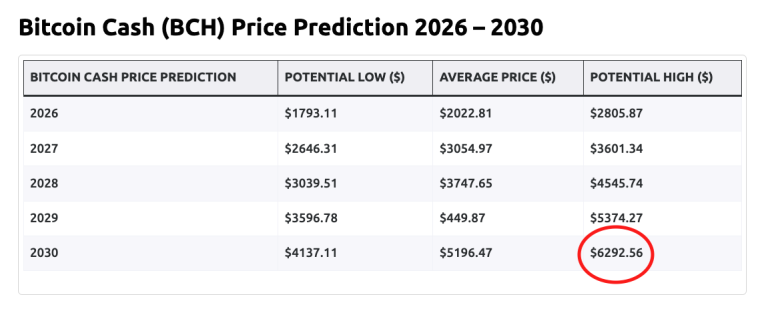

Even more optimistic than that, the site that made the above-mentioned $1500 prediction is predicting a 2030 maximum price of over $6,000. Is that realistic? Who knows. But if cryptocurrency truly goes mainstream and becomes a major player in the global financial system, anything is possible.

Bitcoin Cash Technical Analysis

Alright, let’s get technical. If you’re thinking about investing in Bitcoin Cash, it’s important to understand the key indicators and what they mean for the price.

BCH’s 2024 Roadmap: Key Indicators to Watch and Trade

One thing to keep an eye on is the moving averages. If the price stays above the 50-day and 200-day moving averages, that’s a good sign that the bullish trend is intact. You’ll also want to watch for key support and resistance levels. If the price breaks above a major resistance level, that could signal a breakout to the upside.

BCH Technical Analysis: 2024 Halving Paves the Way for Significant Gains

As I mentioned earlier, the recent halving event this year could be a major catalyst for Bitcoin Cash. Historically, cryptocurrencies have seen big price increases in the months leading up to and following a halving. If you look at the price history, you can see that BCH has already started to show some bullish price action. If that trend continues, we could be in for some exciting times ahead.

Is Bitcoin Cash a Good Investment?

So, the million-dollar question: is Bitcoin Cash a good investment? Well, like any investment, it comes with risks. But there are also some compelling reasons to consider adding BCH to your portfolio. Predicting the short-term price movements of any cryptocurrency is tough. The market is highly volatile and can be influenced by all sorts of factors, from regulatory changes to tweets from Elon Musk. That being said, many experts are bullish on Bitcoin Cash in the long run. They believe that its faster transaction speeds and lower fees give it a real advantage over Bitcoin. As more businesses start accepting BCH and more people start using it for everyday transactions, the demand for the coin could increase, driving up the price.

Should I Invest in Bitcoin Cash?

Ultimately, whether or not to invest in Bitcoin Cash is a personal decision that depends on your goals, risk tolerance, and understanding of the technology. If you believe in the long-term potential of cryptocurrency and think that Bitcoin Cash has a role to play in the future of money, it could be a good addition to your portfolio. But as with any investment, it’s important to do your own research, understand the risks, and never invest more than you can afford to lose. As someone who’s been in the crypto space for a while, I clearly think Bitcoin Cash is worth keeping an eye on. It’s got a strong community behind it and some real potential to shake things up in the world of finance. But don’t just take my word for it. Do your own due diligence, and make the decision that’s right for you.

Key Takeaway:

Bitcoin Cash’s journey since its 2017 fork from BTC has been eventful, with predictions for its future varying widely. Experts suggest a bullish trend, seeing potential prices up to $1,500 by 2024 and even hitting the $6,000 mark by 2030. Its advantages over BTC in transaction speed, fees, and smart contracts could make it appealing for broader adoption. However, investing in BCH carries risks alongside these optimistic forecasts.

Bitcoin Cash Fundamentals

Bitcoin Cash is a fascinating cryptocurrency that emerged from a hard fork of the Bitcoin protocol in 2017. It was created by a group of developers and miners who believed in Satoshi Nakamoto’s original vision for Bitcoin as a peer-to-peer electronic cash system. They, along with other supporters, saw that Bitcoin’s 1 MB block size limit was hindering its ability to scale and function as a practical digital currency.

What is Bitcoin Cash Used For?

Bitcoin Cash steps up with the goal of being your go-to digital currency for buying your morning coffee and more, aiming to handle transactions big and small with ease. Its larger block size, currently up to 32 MB (and soon even more as demand increases), allows for faster and cheaper transactions compared to BTC. Now, even small spends such as your daily cup of joe or giving a shoutout with a tip to someone awesome on the internet becomes doable. But wait, there’s more to BCH than just transferring funds between peers. For sending money across borders or doing international business, it slashes the fees and speeds up transaction times compared to common methods. The Bitcoin Cash ecosystem supports tokens, smart contracts, and private payments through tools like CashFusion.

How Does Bitcoin Cash Differ from Bitcoin?

The primary difference between the two started with the block size. Bitcoin Cash has a much larger block size than BTC, allowing it to process significantly more transactions per second. During a stress test in 2018, Bitcoin Cash easily processed two million transactions in a single day. That’s around 15,000 transactions per block, while BTC typically processes only a few thousand. The reason these two cryptocurrencies don’t match up in power comes down to what they each think is most important.

As we’ve watched them grow up side by side – most people think of BTC as a savings account nowadays; meanwhile, Bitcoin Cash? That’s your wallet full of cash ready for spending on whatever you need when out and about. Ideologically, Bitcoin Cash supporters view it as the true continuation of Satoshi Nakamoto’s vision, as outlined in the original Bitcoin whitepaper. They believe that by increasing the block size and enabling more transactions, Bitcoin Cash is fulfilling the purpose of a “peer-to-peer electronic cash system.”

Since the 2017 split, Bitcoin Cash has evolved away from BTC in many more ways besides the larger block size. The goal is not to just be faster and cheaper. Bitcoin Cash aims to be a far-reaching smart network of all sorts of innovative payment solutions. To further this ideal, BCH has instant (0-conf) transactions, enhanced scripting, double-spend (fraud) detection, sophisticated smart contract capabilities, native tokens, and much more besides.

Read More: What is the Difference Between Bitcoin and Bitcoin Cash?

Bitcoin Cash Adoption and Use Cases

Bitcoin Cash may have started as a contentious hard fork, but it has since carved out its own niche in the cryptocurrency space. Its focus on fast, cheap transactions has attracted a growing number of users and businesses.

Self Custody of Bitcoin Cash

If you acquire some BCH, you can only take advantage of the primary benefits of the coin by getting it off exchanges and taking self custody in a wallet you fully control. It’s best to use a wallet geared towards Bitcoin Cash rather than a multicoin wallet that doesn’t necessarily keep up with the latest developments. And always remember to back up your seed phrase so you never lose your funds.

Companies and Services Already Utilizing Bitcoin Cash

Many well-known companies have started accepting BCH as payment, giving it real-world utility. Online retailers like Newegg and Overstock allow customers to pay with Bitcoin Cash. In the realm of digital payments, BitPay has integrated Bitcoin Cash, enabling merchants to easily accept BCH. Pockets of Bitcoin Cash ecosystems have popped up in places like St. Kitts in the Caribbean, Townsville in Australia, and Tacloban City in the Philippines. Besides those, thousands of merchants around the world have started accepting Bitcoin Cash, showcasing the potential for BCH in brick-and-mortar settings.

As more businesses adopt Bitcoin Cash, its use cases will continue to expand. Its low fees make it ideal for micro-transactions, such as tipping online content creators or making small charitable donations. BCH could also streamline international trade by reducing the costs and delays associated with cross-border payments. In developing countries where access to traditional banking is limited, Bitcoin Cash could provide a means for financial inclusion. For those without easy bank access, its welcoming doors and simple setup make it really appealing worldwide.

Can You Spend Bitcoin Cash?

Absolutely. And spending BCH is becoming easier every day. Many cryptocurrency exchanges and wallets support Bitcoin Cash, allowing you to buy, store, send, and receive BCH. You can use these wallets to pay for goods and services at accepting merchants, both online and in physical stores. With every new person embracing Bitcoin Cash, expect doors to open for even niftier spending avenues. Its fast transaction times, low fees, and growing network of accepting businesses make it an increasingly viable digital currency for real-world use.

Key Takeaway:

Bitcoin Cash shines as a practical digital currency for daily buys, thanks to its big block size ensuring quick and cheap transactions. The Bitcoin Cash community has been pushing the coin to follow Satoshi’s vision more closely than BTC, aiming at easy everyday use from coffee shops to cross-border payments.

Conclusion

So, is Bitcoin Cash a good investment? It’s a question that’s been on the minds of many crypto enthusiasts. While BCH has its pros, like faster transactions and lower fees compared to BTC, it’s not without its risks.

The crypto market is notoriously volatile, and BCH is no exception. Its value can swing wildly from day to day, making it a potentially stressful investment for those who can’t stomach the ups and downs.

But if you believe in the potential of peer-to-peer cash and think BCH has a bright future, it could be worth considering as part of a diversified crypto portfolio. Just remember to do your own research, understand the risks, and never invest more than you can afford to lose.

Whether you decide to take the plunge with BCH or explore other crypto options, one thing’s for sure: the world of digital currencies is never boring. Stay informed, stay curious, and happy investing!

Stay in the loop – subscribe to receive instant notifications on our latest blog posts, delivered straight to your inbox