What is the Difference Between Bitcoin and Bitcoin Cash? – Part 2: Charting the Course

Explore the Full Series of

“What is the Difference Between Bitcoin and Bitcoin Cash?”

Part 2:

Charting the Course

In the ever-evolving world of cryptocurrencies, it’s not just the underlying technology that sets them apart, but the philosophical foundations that guide their development.

This exploration takes us deeper into the fascinating divergence between two digital giants, Bitcoin and Bitcoin Cash. Part 2 of this series focuses on the pivotal aspect of each coin’s objective, providing insights into their roadmaps, zero-confirmation transaction policies, funding models, decentralization aspects, and views on global adoption – all aspects that define the unique identities and aspirations of these blockchain networks.

As we venture further into this intricate realm, we will uncover how these disparities shape the core attributes of Bitcoin and Bitcoin Cash, ultimately influencing their roles in shaping the financial future.

Table of Contents:

The Original, Unified Bitcoin

Digital Gold

Electronic Peer-to-Peer Cash

0G Bitcoin

0-Conf Confusion

0-Conf Confidence

Big-Money Backing

Decentralized Donors

Faith in Full Nodes

Decentralized Where it Counts

Bounded Base Layer

Back to Basics

BCHFAQ Flipstarter - Phase 2

Join the Bitcoin Cash Revolution: Fund More Informative Content on BCHFAQ

Roadmaps and Vision

Cryptocurrencies continue to carve their place in the financial landscape. But before the code and development set each coin apart, the overarching visions first guide the journey. The two digital titans Bitcoin (BTC) and Bitcoin Cash (BCH) are defined not only by their origins but also by their aspirations for the future. Understanding the roadmap and vision of each coin is essential for grasping their unique identities and the paths they intend to tread. In this section, we contrast the grand visions and roadmaps of BTC and Bitcoin Cash. Through this lens, we’ll uncover the distinct ambitions that shape these cryptocurrencies and how they plan to reshape the financial world.

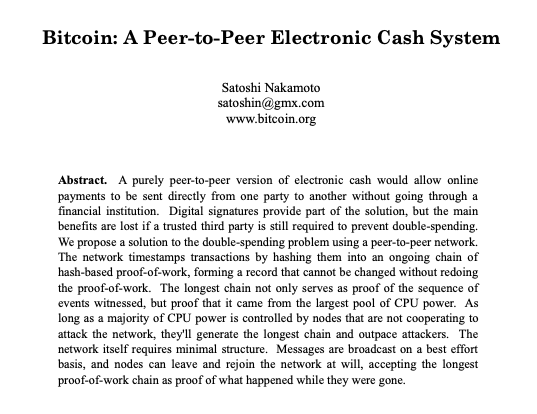

The Original, Unified Bitcoin

In the original Bitcoin whitepaper, Satoshi Nakamoto described Bitcoin as “a peer-to-peer electronic cash system.” Back in the early days of Bitcoin, this succinctly captured the essence of its vision. The primary objective was to establish a practical digital currency capable of accommodating millions of users without encountering scalability limitations.

The concept of diverting transactions to side chains or alternative networks was not part of the plan. Bitcoin was seen as the ultimate medium for facilitating peer-to-peer transactions across the globe. Its early advocates foresaw a future where individuals and businesses could engage in instantaneous commerce, completely independent of central authorities.

Digital Gold

Over the past few years, BTC has undergone a transformation in its vision. It’s now more commonly referred to as “digital gold” rather than a peer-to-peer cash system. Current BTC advocates focus on the properties of a rare digital asset that’s immune to counterfeiting and tampering. With this primary vision in mind, there’s reduced attention on the coin’s transactional capabilities. The aspiration is for more users and institutions to invest in and hold BTC, driving its long-term value.

In terms of BTC’s development roadmap, significant updates have been infrequent, with just two occurring in the past six years. The primary focus has shifted away from the blockchain, with a substantial emphasis on enhancing the Lightning Network to facilitate off-chain transactions. Surprisingly, these endeavors persist, even though the amount of BTC locked up on the Lightning Network remains relatively low.

The ongoing focus on off-chain solutions reflects BTC proponents’ long-term strategy of positioning BTC as a store of value rather than a medium of exchange, aiming to attract a broader user base and institutional investments to hodl (rather than use) BTC in the pursuit of a continually-appreciating asset in terms of national fiat currencies.

Electronic Peer-to-Peer Cash

Bitcoin Cash remains steadfastly committed to Satoshi Nakamoto’s initial vision. Development consistently prioritizes enhancements to on-chain transactions, ensuring the network’s ability to accommodate an extensive user base, potentially reaching millions of users at a minimum.

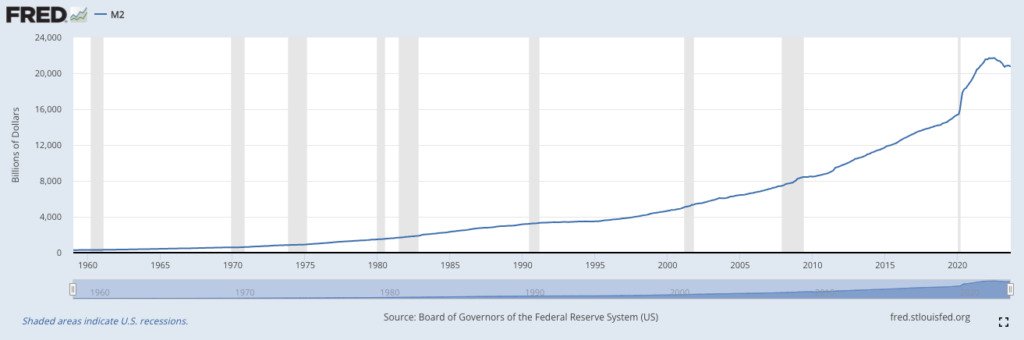

Bitcoin Cash proponents hold a strong and pervasive skepticism toward national currencies, particularly in light of escalating inflation rates in recent years. Should fiat currencies succumb to excessive inflation and potential economic collapse, the Bitcoin Cash community aspires to position their cryptocurrency as a reliable alternative, ready to meet the demand for fast electronic transactions that might otherwise remain unfulfilled by failing fiat currencies.

The unwavering commitment to this vision has propelled Bitcoin Cash through a series of substantial updates, with ongoing annual improvements. These updates encompass enhancements not only to the block size but also to areas such as smart contract capabilities, tokenization protocols, difficulty adjustment algorithms, and a wide array of scaling and efficiency optimizations.

Key Takeaway:

The fundamental difference between BTC and Bitcoin Cash lies in their contrasting visions and roadmaps. BTC, once envisioned as a peer-to-peer electronic cash system, has evolved into a digital gold store of value with limited development updates, emphasizing investment and wealth preservation. In contrast, Bitcoin Cash remains committed to the original vision, striving for on-chain payments and scalability to serve millions of users, positioning itself as a potential alternative to national currencies in times of economic turmoil, leading to frequent updates and improvements. These distinct visions shape the unique identities and goals of these cryptocurrencies in the evolving financial landscape.

0-Conf Transaction Policies

If you’ve delved into debates between proponents of BTC and Bitcoin Cash, you’ve likely encountered the term “0-conf,” an abbreviation for zero-confirmation transactions. This term refers to transactions that have been broadcasted to the network but have not yet received confirmation by being included in a block.

The concept of 0-conf has consistently sparked controversy. This stems from the technical reality that a transaction awaiting confirmation might never be confirmed. Various factors contribute to this uncertainty—miners might reject confirmation due to insufficient fees, or the sender might engage in double-spending, swiftly replacing the transaction to redirect the funds back to themselves. Consequently, accepting 0-conf transactions involves a non-zero amount of risk.

A profound disagreement exists between the two coins concerning the utility of 0-conf and its role in the ecosystem. While diverse opinions on this matter are expected within each coin’s community, we will explore the typical viewpoints on 0-conf that one is likely to encounter.

0G Bitcoin

The viability of 0-conf use cases was initially deliberated and acknowledged in the early days of Bitcoin. In an old thread on bitcointalk, Satoshi himself outlined a conceivable system wherein a snack machine could confidently accept 0-conf transactions. In essence, the proposed example involved a monitoring service that scans the network for any double-spend attempts. If no double-spends are detected within a few seconds of the initial transaction, it would be deemed highly secure.

Even during that early period, it was understood that, with sensible precautions, individuals could confidently accept 0-conf payments and proceed to deliver their goods or services at the point of sale. Despite these rational demonstrations supporting 0-conf, a segment of the Bitcoin community remained skeptical about its utility.

0-Conf Confusion

Following the split from Bitcoin Cash, most of the pivotal developers on BTC have either been hesitant to endorse 0-conf or have outright attacked it. Given BTC’s trajectory, shifting away from peer-to-peer payments and emphasizing its role as “digital gold,” there has been a diminished emphasis on use cases centered around electronic cash. Therefore, the idea of instantly trading BTC for goods and services has fallen by the wayside.

Due to the constrained block space in BTC, transaction fees can escalate unexpectedly, sometimes becoming extremely expensive. Consequently, BTC has shifted its perspective on double-spending, treating it as a feature rather than a risk to be mitigated. The current system employs opt-in Replace-By-Fee (RBF), allowing users to flag a transaction for potential future replacement with one that includes a higher fee. With this flag in place, network nodes actively monitor and accept higher-paying double-spends.

Although RBF proves beneficial for users with low-fee transactions struggling to get confirmed, it presents a significant obstacle for accepting BTC in point-of-sale transactions. This limitation substantially diminishes any cash-like attributes BTC might possess. Moreover, the imminent arrival of full-RBF by default in BTC suggests a definitive rejection of 0-conf transactions within the Bitcoin network.

0-Conf Confidence

In contrast, Bitcoin Cash not only acknowledges the potential for 0-conf use cases but actively endorses them. The overarching objective of the Bitcoin Cash community is to establish the most cash-like cryptocurrency feasible. This entails facilitating immediate trades for goods and services, with businesses reasonably assured that payments are final.

A critical aspect ensuring the reliability of 0-conf for instant purchases is effective scaling. When there’s consistently ample room in the next block for transactions, the likelihood of a transaction getting stuck and remaining unconfirmed is close to zero. Even in scenarios where Bitcoin Cash experiences a sudden surge in activity, potentially filling several consecutive blocks, there remains a high certainty that all transactions will ultimately be confirmed. Consequently, the need for RBF is effectively eliminated.

However, the potential to defraud a merchant at the point of sale by double-spending persists. To make 0-conf nearly impervious, an additional component is required, and that’s where Double-Spend Proofs (DSPs) come into play. DSPs essentially materialize the concept Satoshi discussed in that notable thread back in 2010.

The fundamental concept involves nodes detecting if a UTXO (Unspent Transaction Output) has been spent in two separate transactions to different addresses. The digital signature of the spender serves as proof of an attempted double spend. When a double spend is identified, nodes can transmit a message containing the DSP to other nodes.

Consider a merchant accepting Bitcoin Cash with DSPs enabled on their point-of-sale system. All they need to do is wait a few seconds to check for any DSP messages. If none appear, they can confidently proceed with delivering the goods. With functionality as fast as a credit card POS system, this functionality positions Bitcoin Cash as a seamless peer-to-peer cash solution in numerous retail settings.

Nevertheless, instantly accepting 0-conf is not necessarily recommended in all scenarios. One potential avenue for double spending involves collusion with a miner. In scenarios where a transaction encompasses a substantial amount, it may be enticing for the spender to dispatch a double-spend directly to a colluding miner who could, in theory, confirm it without triggering any DSP alerts. Consequently, sellers dealing with significant transactions, such as property, vehicles, or large exchange deposits, are advised to exercise caution and await at least one confirmation before finalizing a sale.

Key Takeaway:

In the realm of zero-confirmation transactions (0-conf), the divide between BTC and Bitcoin Cash is stark. While BTC has shifted away from emphasizing peer-to-peer transactions and discourages 0-conf via Replace-By-Fee (RBF) node policies, Bitcoin Cash actively endorses and aims to optimize 0-conf for seamless, instant transactions. With its commitment to being the most cash-like cryptocurrency, Bitcoin Cash utilizes Double-Spend Proofs (DSPs) to fortify 0-conf reliability, making it a practical choice for immediate retail transactions. However, waiting for a confirmation is advised when accepting large sums.

Funding Models

In this section, we peel back the layers to uncover the mechanisms and financial sustenance behind the development of BTC and Bitcoin Cash. The development of any blockchain, no matter how decentralized its vision, relies on resources and support. Understanding the distinct approaches taken by these two cryptocurrencies in securing their funding is key to comprehending how they sustain and innovate, all while striving to maintain the principles that set them apart.

Big-Money Backing

During the early days, BTC protocol development was entirely voluntary. Developers who recognized the idea’s potential could accumulate bitcoins, even when their monetary value was minimal or nonexistent.

A significant shift occurred in 2012 with the establishment of the Bitcoin Foundation. Its primary purpose was to support BTC’s development and promote a positive image for the cryptocurrency. To fund these objectives, the foundation sought donations from the community and BTC-related businesses, allowing developers to receive compensation for their efforts in maintaining and enhancing the code.

The landscape of BTC development took another turn in 2014 with the founding of Blockstream, a for-profit company specializing in blockchain-related products. Blockstream embarked on an aggressive hiring campaign, bringing several influential Bitcoin developers into its fold. A primary focus for Blockstream was the development of products related to the Lightning Network, a protocol designed for off-chain BTC transactions.

Concerns arose within the BTC community due to a perceived conflict of interest when it became evident that Blockstream, which had a keen interest in shifting payments off the BTC blockchain, was employing a substantial number of BTC developers. Blockstream’s initial funding was boosted by investments from AXA Strategic Ventures. Further financial backing came from the Digital Currency Group, a venture capital firm partly supported by MasterCard, a notable player in the payments sector and perceived as a competitor to BTC.

Ongoing financial support for BTC development remains a multi-faceted landscape, with both for-profit and nonprofit entities contributing to the cryptocurrency’s codebase. This collaborative effort involves various cryptocurrency-focused organizations and other groups committed to advancing the development of BTC.

Decentralized Donors

Following the 2017 split that separated BTC and Bitcoin Cash, the primary source of funding for Bitcoin Cash development has been voluntary donations. The different node implementations within the Bitcoin Cash ecosystem relied on the support of donors to sustain their development efforts.

After a few years, BitcoinABC, the initial reference implementation of Bitcoin Cash, claimed it was facing resource constraints that hindered its progress. Consequently, the team proposed a protocol adjustment aimed at levying an 8% tax on newly-minted coins and transaction fees in every block, directing the proceeds to an address under their control. This move was justified by Bitcoin ABC as a vital measure to sustain and advance their ongoing development initiatives.

Condemnation of this move from the Bitcoin Cash community was swift. Seemingly overnight, a group of developers published a drop-in replacement for BitcoinABC, called Bitcoin Cash Node (BCHN). The replacement refused to put in the proposed tax policy. Over the months leading up to the proposed change, the overwhelming majority of Bitcoin Cash miners switched from BitcoinABC to BCHN, demonstrating their rejection of the tax proposal.

When BitcoinABC activated their tax, they forked themselves off of the Bitcoin Cash network and created a new chain. From the perspective of Bitcoin Cash, the community successfully “fired” their leading node team when they weren’t doing a satisfactory job.

The teams of the various Bitcoin Cash node implementations continue to receive their funding through decentralized, voluntary means. One tool employed by most node teams to solicit funding is Flipstarter, an implementation of an assurance contract. Anyone can use Flipstarter to create a fundraising campaign and publish a funding goal. Over the life of the campaign, the Flipstarter instance collects on-chain pledges from contributors. As soon as the goal is met, a transaction is created with all the inputs from the contributors’ coins and the funds are instantly sent to the campaign creator. Node teams have been using this novel tool for years now to great effect.

Key Takeaway:

The funding models for BTC and Bitcoin Cash highlight their divergent approaches to sustaining development. BTC’s journey includes voluntary contributions, the establishment of the Bitcoin Foundation, and the involvement of for-profit companies like Blockstream, which raised concerns of potential conflicts of interest. In contrast, Bitcoin Cash primarily relies on voluntary donations. BitcoinABC’s attempt to introduce an 8% tax on newly-minted coins resulted in their ousting and sparked the creation of a replacement, Bitcoin Cash Node (BCHN). The Bitcoin Cash community remains committed to decentralized, voluntary funding mechanisms, utilizing tools like Flipstarter to support various node implementations, exemplifying their dedication to maintaining a grassroots approach to financial sustenance.

Decentralization

From the inception of Bitcoin, decentralization was a fundamental requirement. Satoshi Nakamoto’s decision to make the software open source, encourage user contributions to the code, and invite participation in the mining process exemplified this commitment. In the earliest days, all users played a part in mining. Importantly, there was no substantial premining of coins; from the outset, every individual had an equal opportunity to generate new coins.

The process of securing the Bitcoin ledger gradually evolved towards greater decentralization, with an increasing number of participants involved in transaction verification. Mining, in due course, transformed into a highly specialized operation, demanding specialized equipment and establishing itself as a distinct industry.

Decentralization remains a key focus for both BTC and Bitcoin Cash. Nevertheless, each coin holds slightly different perspectives on the precise nature of decentralization, the contributing factors, and how it is sustained. Significantly, disagreements on decentralization first came to the fore during the block size wars. Let’s delve into these differences.

Faith in Full Nodes

As more Bitcoiners expressed the need for a larger block size, a distinct decentralization narrative emerged among some key developers and community moderators. This narrative countered the block size increase, presenting a unique rationale.

Opponents of the block size increase argued in favor of keeping the block size small to enable regular users to sustain a full node with the complete blockchain history on their device. This perspective suggested that ordinary users should utilize a full node to independently verify the network as a safeguard against miners.

Advocates for a block size increase countered the emerging narrative, emphasizing that regular users are neither required nor have the capacity to serve as a check on miners. Miners play a crucial role in securing the Bitcoin network through proof-of-work. While regular users can operate non-mining nodes, these nodes essentially grant them observer status, allowing them to monitor network activity but lacking the ability to safeguard the network or to substantially challenge the miners.

The narrative initiated during the block size debates persists among BTC proponents, advocating that regular users should download the blockchain and run full nodes to contribute to the network. However, in practice, few regular users actually take up this suggestion.

Decentralized Where it Counts

Bitcoin Cash proponents hold a different perspective on decentralization. They do not impose any obligation on regular users to download the entire blockchain and run full nodes, nor do they claim that regular users can oversee miners on the network. In fact, any efforts by a regular user to oppose mining nodes would promptly lead to their separation from the network, subjecting them to alternative (and ultimately meaningless) protocol rules.

The Bitcoin Cash community actively promotes decentralization through practical and significant means. Multiple Bitcoin Cash node implementations are available to support various infrastructure and projects. Even miners have the option to choose from alternative clients, adding to the overall decentralization of the network.

The Bitcoin Cash community embodies a spirit of decentralization in its approach to problem-solving. Rather than relying on top-down development, the community encourages its members to take initiative. The mantra is clear: If you want something built, take action and build it, as waiting for others to do it is not a sustainable solution. This decentralized mindset fosters innovation and a grassroots approach to development.

In contrast to BTC, Bitcoin Cash adheres to a decentralized approach without a central development team, reference client, or official foundation responsible for fund allocation. There’s no single authority in charge. Instead, anyone who wishes to contribute to the project can do so by presenting their ideas, soliciting feedback, engaging in ongoing discussions, and collectively working toward implementing positive changes. This decentralized model ensures that the community actively shapes the coin’s development.

This decentralized model, while potentially slower in terms of progress, serves as a robust filter, allowing only the most refined ideas to be incorporated into the protocol. Furthermore, it acts as a formidable barrier against any individual or group attempting to seize control of the project and foster a cult of personality around themselves. This collective and inclusive approach promotes a healthy, community-driven evolution of Bitcoin Cash.

Key Takeaway:

Decentralization is a core principle for BTC and Bitcoin Cash, though they differ in theories and approaches. BTC proponents push for small block sizes and encourage regular users to run full nodes to make the blockchain as accessible as possible and to check the work of miners. While this approach appears reasonable, it cannot meaningfully police mining nodes and overall it is rarely practiced anyway. Bitcoin Cash takes a different approach, not obligating regular users to run full nodes and promoting decentralization through multiple node implementations and grassroots initiatives. Unlike BTC, Bitcoin Cash lacks a central development team or foundation, allowing decentralized community contributions, filtering for quality ideas, and preventing central control.

Global Adoption

Since the inception of Bitcoin, its proponents harbored grand visions for the coin’s future. The community drew in individuals from the liberty movement, particularly those hoping for an alternative to national fiat currencies. Within this group, the belief was strong that Bitcoin had the potential to emerge as a genuine free-market, decentralized currency, offering economic freedom to individuals worldwide. This shared vision ignited hope for a financial system outside the control of centralized authorities.

Taking this notion to its furthest extreme, some envisioned a future where all fiat currencies would inevitably crumble, leaving Bitcoin as the predominant global currency by default.

While the long-term future remains uncertain, there is a noticeable difference in how enthusiasts of BTC and Bitcoin Cash view the prospect of global adoption.

Bounded Base Layer

With its restricted block size, BTC can handle a maximum of around seven transactions per second. Given the unlikelihood of a block size change, BTC supporters have generally accepted that global adoption, if it materializes, won’t occur on the base layer. Instead, advocates of BTC have turned to the Lightning Network (LN) as their primary solution for achieving global adoption.

The LN is envisioned as a solution to circumvent the limitations of the BTC base layer while interconnecting all users through a network of payment channels. In theory, users can conduct numerous transactions within this network without the need to settle on the base layer. Consequently, BTC supporters believe that it remains feasible for people worldwide to embrace and utilize BTC in their daily lives.

Regrettably, the LN has fallen short of the expectations held by BTC users. It has grappled with liquidity challenges, routing complexities, and a persistent array of bugs and attack surfaces. Notably, a key LN developer stepped away from the project, citing systemic issues that would demand a substantial overhaul to resolve.

Even in a scenario where the LN is bug-free and secure, a substantial barrier to global adoption remains. Opening Lightning channels requires an initial on-chain transaction, necessitating control of the private keys of some amount of BTC. Given BTC‘s limited transaction capacity, onboarding a significant portion of the population in this manner would be impractical due to the extended time it would require.

Even with a capacity of 7 transactions per second, a sustained effort to onboard 1 billion people to the Lightning Network would take over four years, during which time BTC’s blockchain couldn’t be used for anything else. A more realistic approach, reserving a full 25% of transaction capacity for LN onboarding, would still take over 18 years to reach 1 billion users. And that’s not even accounting for the likelihood of most users needing several channel openings and eventual channel closures. The Lightning Network falls short in offering a practical path to global adoption for BTC in a reasonable amount of time.

Recognizing these challenges, some BTC proponents have started advocating custodial Lightning Network solutions or non-LN custodial BTC. These would enable users to “transact” on the LN or on the BTC base layer but relinquish control of their BTC. Users would become customers of bank-like entities who hold full custody of BTC funds and transact on behalf of those users. Regrettably, this approach could risk recreating the problems of the existing financial system, including the perils of fractional reserve banking.

As of now, no viable model for achieving global adoption of BTC – while preserving its properties as sound money held directly by users, without intermediaries – has been found.

Back to Basics

Bitcoin Cash proponents have consistently adhered to the original vision of global adoption, maintaining the hope of expanding the block size to meet growing demand.

Bitcoin Cash has maintained a primary focus on scaling at the base layer, avoiding heavy reliance on second-layer scaling solutions. It’s worth noting that this approach doesn’t necessarily oppose second-layer scaling, as some community members have suggested that technologies like the Lightning Network could perform more effectively on the Bitcoin Cash network. While there’s room for the development of payment channels within the protocol in the future, there is absolutely no need to require users to use such payment channels.

Bitcoin Cash maintains a vision of accommodating the entire global population of potential users. This perspective shapes its approach to scalability, with no set cap on the block size. Instead, mining clients incorporate a user-configurable excessive blocksize (EB). Over the past few years, the EB has been set to 32 MB as a stepping stone to the ambitious goal of global adoption.

With an estimated average transaction size of 250 bytes, a 32 MB block size allows for over 200 transactions per second. This level of throughput can support more than 9 million users making two transactions per day. However, Bitcoin Cash’s vision extends even further, aiming for broader global adoption.

Extensive research has explored the feasibility of much larger blocks, such as 256 MB and 1 GB blocks, even on relatively modest hardware. 1 GB blocks, in particular, could enable the entire population of a large country to conduct multiple daily transactions. While there are still technical challenges to overcome before achieving global-scale adoption, the Bitcoin Cash community remains optimistic that ongoing technological advancements will pave the way for this ambitious vision.

Key Takeaway:

When it comes to the prospect of global adoption, BTC and Bitcoin Cash hold distinct visions. BTC, constrained by a limited block size and relying on the Lightning Network, strives for worldwide acceptance despite the Lightning Network’s challenges, liquidity issues, and the impracticality of onboarding billions of users through its channels. Meanwhile, Bitcoin Cash maintains its original vision by focusing on on-chain scaling, with no strict cap on block size. The network aims for millions of daily users with a current 32 MB block size; with ongoing research into much larger blocks, such as 256 MB and 1 GB, which could eventually serve entire nations. While challenges remain, Bitcoin Cash proponents are confident that technological progress will lead to global adoption.

Conclusion

Our exploration into the disparities between BTC and Bitcoin Cash has illuminated profound distinctions extending beyond technological differences. These cryptocurrencies, originating from the same blockchain, have diverged in their paths, marked by unique visions, transaction policies, funding approaches, and aspirations for global adoption.

Decentralization remains a shared core principle in both BTC and Bitcoin Cash, tracing back to Satoshi Nakamoto’s initial design philosophy of open-source collaboration. The debates over block size and governance structures underscore the enduring commitment to decentralization. However, the devil lies in the details, with decentralization taking on distinct forms in each coin. BTC advocates for user-run full nodes and network verification, while Bitcoin Cash adopts a more pragmatic approach, encouraging innovation without imposing such obligations.

Global adoption is a shared ambition, yet the strategies diverge. BTC explores the Lightning Network, an off-chain solution with both promise and challenges, aiming to overcome block size limitations. In contrast, Bitcoin Cash opts for peer-to-peer cash use cases and on-chain scaling, envisioning blocks extending beyond 32 MB to potentially gigabyte-sized, accommodating entire nations.

In the intricate world of cryptocurrencies, success or failure often hinges on nuanced differences, encompassing not only technological aspects but also underlying values, governance structures, and ultimate aspirations. The distinctions between BTC and Bitcoin Cash transcend code, encapsulating the very essence of their distinct visions, leaving us with a comprehensive understanding of the multifaceted landscape they navigate.

Explore the Full Series of

“What is the Difference Between Bitcoin and Bitcoin Cash?”

Part 2:

Charting the Course

Stay in the loop – subscribe to receive instant notifications on our latest blog posts, delivered straight to your inbox